Imagine a scenario where a single accident could wipe out your life savings. It’s a chilling thought, but a reality for many individuals who lack adequate insurance coverage. Enter umbrella insurance, a powerful shield that can safeguard your financial well-being against catastrophic events. This comprehensive coverage acts as a safety net, extending protection beyond your existing policies and providing peace of mind in the face of unforeseen circumstances.

This guide delves into the world of umbrella insurance, offering insights into its benefits, factors influencing quotes, and the steps involved in obtaining the right coverage. Whether you’re a homeowner, business owner, or simply seeking financial security, understanding umbrella insurance can empower you to make informed decisions and protect your assets from potential risks.

Understanding Umbrella Insurance

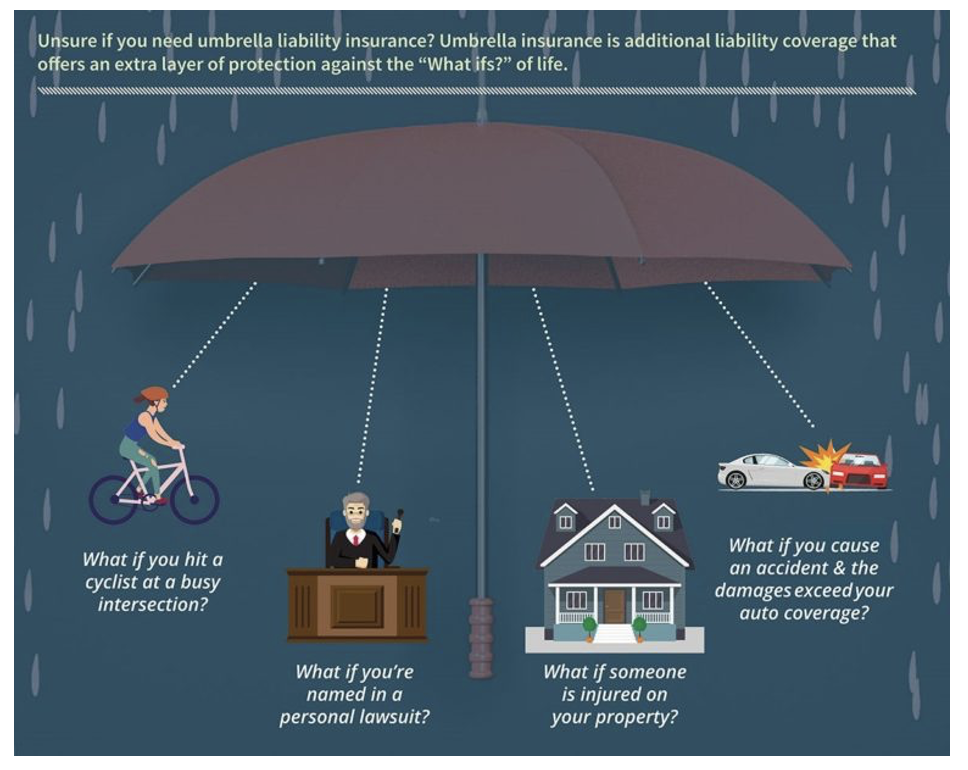

Umbrella insurance, also known as excess liability insurance, provides an extra layer of financial protection beyond the limits of your existing liability insurance policies, such as homeowners, auto, or renters insurance. It acts as a safety net, safeguarding you from significant financial losses arising from unexpected lawsuits or claims exceeding your primary insurance coverage.

Examples of Situations Where Umbrella Insurance Would Be Beneficial

Umbrella insurance can be invaluable in a variety of situations, offering protection beyond standard coverage. For instance, if you are involved in an accident that results in a substantial claim exceeding your auto insurance limits, umbrella insurance would step in to cover the remaining costs. Similarly, if you are sued for negligence, such as a slip and fall on your property, umbrella insurance can help mitigate the financial burden associated with legal fees and potential settlements.

- Accidents Involving Significant Damages: In cases where you are found liable for an accident causing significant injuries or property damage, umbrella insurance can cover the excess liability exceeding your primary insurance limits.

- Lawsuits Arising from Negligence: If you are sued for negligence, such as a slip and fall on your property or a dog bite, umbrella insurance can provide coverage for legal defense costs and potential settlements.

- Libel or Slander: If you are accused of defamation, umbrella insurance can help cover the costs associated with legal defense and potential settlements.

- Unintentional Injury to Others: If you accidentally injure someone while engaging in activities like recreational sports or home repairs, umbrella insurance can provide coverage beyond your primary liability insurance limits.

The Difference Between Liability Coverage and Umbrella Insurance

Liability coverage is typically included in your homeowners, auto, or renters insurance policies. It protects you against financial losses resulting from injuries or damages you cause to others. However, liability coverage has limits, and once these limits are reached, you are personally responsible for any remaining costs.

Umbrella insurance acts as an extension of your liability coverage, providing an additional layer of protection above and beyond your existing policies.

It fills the gap between your primary insurance limits and the potential amount of a claim, offering a higher level of financial security.

Factors Influencing Umbrella Insurance Quotes

Umbrella insurance premiums are determined by a variety of factors that reflect your individual risk profile. Insurance companies carefully assess these factors to calculate a premium that accurately reflects the potential risk they are taking on by covering you.

Impact of Age, Location, Driving Record, and Assets

The age of the policyholder, their location, driving record, and the value of their assets are all key factors that influence umbrella insurance quotes.

- Age: Younger drivers tend to have higher insurance premiums due to their higher risk of accidents. Older drivers, on the other hand, may benefit from lower premiums as they have more experience and a lower risk profile.

- Location: The location where you reside can significantly impact your premium. Areas with higher crime rates, traffic congestion, and natural disaster risks will typically have higher premiums. For example, living in a coastal area with frequent hurricanes could lead to a higher premium.

- Driving Record: Your driving history plays a significant role in determining your premium. Drivers with a clean record and no accidents or violations generally enjoy lower premiums. However, a history of accidents, speeding tickets, or DUI convictions will increase your premium.

- Assets: The value of your assets, such as your home, cars, and investments, is a key factor in determining the amount of coverage you need and, therefore, your premium. The higher the value of your assets, the higher the potential risk for the insurance company, and the higher your premium may be.

Risk Assessment for Umbrella Insurance Policies

Insurance companies employ a comprehensive risk assessment process to evaluate your individual risk profile for umbrella insurance. They consider various factors, including:

- Personal History: This includes your driving record, credit history, and any past claims you have filed.

- Lifestyle: Factors such as your hobbies, travel habits, and involvement in risky activities are also considered. For example, if you frequently engage in activities like skiing or motorcycling, your premium may be higher.

- Financial Stability: Your financial stability, as reflected by your income, assets, and liabilities, is another key factor. A strong financial history can contribute to a lower premium.

- Property Value: The value of your home, cars, and other assets is a crucial factor in determining your premium. The higher the value of your assets, the higher the potential risk for the insurance company, and the higher your premium may be.

Types of Coverage Included in Umbrella Insurance

Umbrella insurance, also known as excess liability insurance, provides additional coverage above the limits of your underlying insurance policies, such as homeowners, auto, and personal liability insurance. It acts as a safety net to protect you from significant financial losses due to lawsuits or claims exceeding your existing coverage.

Liability Coverage

Umbrella insurance primarily provides liability coverage, which protects you from financial losses arising from claims of negligence or wrongdoing that result in injury or property damage to others.

This coverage typically applies to situations where you are found legally liable for someone else’s injuries or property damage, exceeding the limits of your primary insurance policies.

- Personal Liability: This coverage protects you against claims arising from accidents or incidents that occur at your home, while you are away from home, or during recreational activities. For example, if a guest trips and falls on your property and suffers a severe injury, your umbrella insurance would cover the costs exceeding your homeowners insurance limits.

- Auto Liability: This coverage extends your auto insurance limits, providing additional protection in case of a serious accident where you are found liable. For instance, if you cause an accident that results in significant injuries and property damage, your umbrella insurance would cover the excess costs beyond your auto insurance limits.

- Watercraft Liability: If you own a boat or other watercraft, this coverage protects you from claims arising from accidents or incidents involving your watercraft. This coverage is essential for boat owners as liability claims can be significant due to the potential for severe injuries or property damage.

Obtaining an Umbrella Insurance Quote

Securing an umbrella insurance quote involves several steps, from gathering essential information to comparing quotes from different insurers. Understanding the process allows you to make informed decisions about your coverage and potentially save money.

Steps to Obtain an Umbrella Insurance Quote

To obtain an umbrella insurance quote, you typically need to contact insurance companies directly, either online, over the phone, or through an insurance broker. Here’s a step-by-step guide:

- Contact Insurance Companies: Reach out to multiple insurance companies to gather quotes. You can do this online, over the phone, or through an insurance broker. Many companies have online quote tools that allow you to quickly get an estimate.

- Provide Personal Information: You’ll need to provide basic information such as your name, address, date of birth, and contact details.

- Provide Information about Your Existing Insurance Policies: You’ll need to provide details about your current homeowners, renters, or auto insurance policies, including coverage limits, deductibles, and claims history.

- Answer Questions about Your Risk Profile: Insurance companies will ask questions about your lifestyle and potential risk factors. This may include details about your home, your driving record, and any other activities that could potentially increase your risk of liability.

- Review and Compare Quotes: Once you receive quotes from different insurers, carefully review the coverage details, premiums, and deductibles. Consider the reputation of the insurance company, its financial stability, and customer service before making a decision.

Information Required for an Umbrella Insurance Quote

Here’s a table outlining the essential information typically required when obtaining an umbrella insurance quote:

| Information Category | Details |

|---|---|

| Personal Information | Name, address, date of birth, contact details, Social Security number |

| Existing Insurance Policies | Homeowners, renters, or auto insurance policy details (coverage limits, deductibles, claims history) |

| Risk Profile | Home ownership details, driving record, any other activities that could potentially increase liability risk |

| Financial Information | Annual income, assets, and debt levels |

| Desired Coverage | Coverage limits, deductibles, and any specific coverage needs |

Tips for Comparing Umbrella Insurance Quotes

To ensure you get the best value, consider these tips when comparing quotes:

- Compare Coverage Limits: Ensure the coverage limits offered by different insurers meet your needs.

- Compare Premiums: Consider the annual premiums charged by different insurers and look for competitive rates.

- Compare Deductibles: Choose a deductible that you can afford to pay in case of a claim. Higher deductibles generally lead to lower premiums.

- Review Exclusions: Carefully review the exclusions in each policy to understand what is not covered.

- Consider the Insurer’s Reputation: Research the insurer’s financial stability, customer service ratings, and claims handling process.

- Get Multiple Quotes: Obtaining quotes from at least three to five insurers allows you to compare options and find the best value.

Benefits of Having Umbrella Insurance

Umbrella insurance provides an extra layer of financial protection, extending coverage beyond your primary liability insurance policies. This type of insurance can offer significant peace of mind, knowing you are financially shielded from catastrophic events that could otherwise drain your savings.

Financial Protection

Umbrella insurance acts as a safety net, covering you for liabilities exceeding the limits of your underlying insurance policies, such as homeowners, auto, or renter’s insurance. This additional coverage can be crucial in situations involving significant personal injury, property damage, or lawsuits, safeguarding you from potentially crippling financial burdens.

Peace of Mind

The peace of mind that comes with umbrella insurance is invaluable. Knowing that you have this extra layer of protection can alleviate stress and anxiety, allowing you to focus on other aspects of your life without worrying about the potential financial repercussions of unforeseen events.

Mitigation of Significant Financial Losses

Umbrella insurance can mitigate significant financial losses that could arise from various events, including:

- Accidents: A car accident involving multiple vehicles or injuries could result in substantial legal and medical expenses exceeding the limits of your auto insurance policy. Umbrella insurance can cover the difference, protecting you from financial ruin.

- Property Damage: A fire or natural disaster that causes extensive damage to your property or someone else’s property can result in significant financial losses. Umbrella insurance can cover the difference between the actual cost of repairs or replacement and the limits of your homeowners or renter’s insurance policy.

- Lawsuits: Being sued for personal injury or property damage can be a stressful and costly experience. Umbrella insurance can cover legal fees, settlements, and judgments exceeding the limits of your underlying insurance policies, providing crucial financial protection.

Comparison with Other Types of Insurance

Umbrella insurance differs from other types of insurance in its scope and purpose. While other insurance policies, such as homeowners, auto, and renter’s insurance, provide primary coverage for specific risks, umbrella insurance acts as a supplementary layer of protection, extending coverage beyond the limits of these policies.

“Umbrella insurance is like a giant umbrella that protects you from financial rain, providing coverage beyond your primary insurance policies.”

Considerations Before Purchasing Umbrella Insurance

Before committing to an umbrella insurance policy, it’s crucial to carefully evaluate your individual circumstances and weigh the potential benefits against the associated costs. This involves a comprehensive assessment of your risk profile, financial situation, and insurance needs.

Understanding Potential Downsides

While umbrella insurance offers significant financial protection, it’s important to acknowledge potential downsides and limitations.

- Policy Exclusions: Umbrella policies typically exclude certain types of claims, such as those arising from intentional acts, business-related activities, or certain types of property damage. Carefully review the policy language to understand what is covered and what is excluded.

- Coverage Limits: The coverage limits of an umbrella policy are typically subject to a self-insured retention (SIR), which is the amount you are responsible for paying out-of-pocket before the umbrella coverage kicks in. The SIR can range from a few hundred dollars to several thousand dollars, depending on the policy.

- Premium Costs: Umbrella insurance premiums can vary significantly depending on factors such as coverage limits, underlying insurance policies, and your risk profile. It’s important to compare quotes from multiple insurers to find the most competitive rates.

Determining Appropriate Coverage Limits

The appropriate coverage limit for an umbrella insurance policy depends on your individual circumstances, including your assets, income, and potential liability exposures.

- Asset Protection: Consider the value of your assets, such as your home, vehicles, investments, and savings. An umbrella policy can help protect these assets from lawsuits or judgments that exceed the limits of your underlying insurance policies.

- Income Protection: If you have a high income or significant professional liability exposure, an umbrella policy can help protect your earnings in the event of a lawsuit. This is particularly important for individuals in professions with high liability risks, such as doctors, lawyers, and business owners.

- Potential Liability Exposures: Evaluate your potential liability exposures, such as owning a dog, hosting social events, or engaging in activities that could lead to accidents or injuries. If you have a higher risk of being sued, you may need a higher coverage limit.

Assessing Your Risk Profile

Your risk profile is a key factor in determining the need for umbrella insurance and the appropriate coverage limits.

- Lifestyle: Your lifestyle can influence your liability risk. For example, individuals who frequently host social gatherings or engage in recreational activities that involve potential hazards may have a higher risk of being sued.

- Occupation: Certain professions, such as doctors, lawyers, and business owners, have a higher risk of facing lawsuits due to the nature of their work. This increased risk may warrant higher coverage limits.

- Location: The location where you live can also impact your liability risk. Areas with high population density or a history of lawsuits may have a higher risk of claims.

Finding the Right Umbrella Insurance Provider

Choosing the right umbrella insurance provider is crucial to ensure adequate protection and peace of mind. A reputable and reliable provider offers financial stability, responsive customer service, and a comprehensive understanding of your needs.

Factors to Evaluate When Choosing an Insurance Provider

- Financial Stability: Assess the insurer’s financial strength and track record. Look for companies with high ratings from independent agencies like A.M. Best, Moody’s, and Standard & Poor’s. A strong financial rating indicates the insurer has the resources to pay claims even in challenging economic times.

- Customer Service: Evaluate the insurer’s customer service reputation. Consider factors like responsiveness, accessibility, and complaint resolution. Check online reviews and ratings from independent platforms like Consumer Reports or J.D. Power.

- Policy Coverage and Exclusions: Thoroughly review the policy terms and conditions, including coverage limits, deductibles, and exclusions. Ensure the policy aligns with your specific needs and risk profile.

- Claims Handling Process: Understand the insurer’s claims handling process. Look for companies with a transparent and efficient claims process. Check if they offer online claims filing and 24/7 customer support.

- Pricing and Discounts: Compare quotes from multiple insurers to find the most competitive rates. Consider factors like deductibles, coverage limits, and available discounts.

- Reputation and Experience: Research the insurer’s reputation and experience in providing umbrella insurance. Look for companies with a proven track record of handling complex claims and providing excellent customer service.

Understanding Policy Terms and Conditions

Understanding the terms and conditions of your umbrella insurance policy is crucial to ensure you have the coverage you need and are aware of any limitations or exclusions. Carefully reviewing the policy document helps you avoid surprises when you need to file a claim.

Key Clauses and Provisions

The policy document contains specific clauses and provisions that affect coverage and exclusions. These are essential for understanding the scope of your protection and potential limitations.

- Coverage Limits: This specifies the maximum amount the insurer will pay for covered losses. The umbrella policy’s limit is typically separate from your underlying liability insurance policies.

- Deductibles: This is the amount you pay out-of-pocket before the umbrella policy starts covering losses. Understanding the deductible helps you budget for potential costs.

- Exclusions: This section lists situations or events that are not covered by the umbrella policy. Carefully reviewing these exclusions helps you understand what is and isn’t protected.

- Self-Insured Retention (SIR): This is a specific amount you are responsible for paying before the umbrella policy kicks in. It is similar to a deductible but often applies to specific types of claims, such as those involving intentional acts.

- Coverage Triggers: This section specifies the events that trigger coverage under the umbrella policy. For example, it may state that coverage only applies when your underlying liability insurance policies have been exhausted.

Understanding Policy Language

Insurance policies often use complex legal jargon, making them difficult to understand.

- Read Carefully: Take your time and read the policy thoroughly, paying attention to each section and provision.

- Seek Clarification: If you have any questions or don’t understand a particular clause, don’t hesitate to contact your insurance agent or broker for clarification.

- Use Resources: Many insurance companies offer online resources, such as glossaries or FAQs, to explain policy terms and conditions in simpler language.

Maintaining Umbrella Insurance Coverage

Your umbrella insurance policy is designed to provide you with extra financial protection in case of a significant liability claim. But just like any other type of insurance, it’s important to review your coverage regularly to ensure it still meets your needs. Over time, your circumstances may change, and your existing policy may no longer provide adequate protection.

Reviewing Your Umbrella Insurance Coverage

Regularly reviewing your umbrella insurance coverage is crucial to ensure it remains relevant and adequate. A comprehensive review should consider factors such as changes in your assets, liabilities, and lifestyle.

- Changes in Assets: As your assets, such as real estate, investments, or valuable possessions, increase, your potential exposure to liability claims also increases. An umbrella policy should provide sufficient coverage to protect these assets.

- Changes in Liabilities: Your liabilities can also fluctuate. For instance, if you take on a business venture or become involved in a lawsuit, your liability exposure may increase.

- Changes in Lifestyle: Lifestyle changes can also impact your need for umbrella insurance. For example, if you become a homeowner, start a family, or take up a high-risk hobby, you may need to increase your coverage.

Adjusting Your Umbrella Insurance Policy

If your circumstances have changed and your current umbrella insurance policy no longer meets your needs, you can adjust it by:

- Increasing Coverage Limits: If your assets, liabilities, or lifestyle have changed, increasing your coverage limits is essential to ensure you have adequate protection.

- Adding Additional Coverage: You may need to add additional coverage, such as coverage for certain types of lawsuits or specific types of claims, depending on your individual circumstances.

- Changing Deductibles: You can adjust your deductible to lower your premiums, but this may result in higher out-of-pocket costs if you need to file a claim.

Maintaining Adequate Coverage Over Time

Maintaining adequate umbrella insurance coverage over time involves several key strategies:

- Regular Reviews: Review your policy at least annually, or more frequently if your circumstances change significantly.

- Communicate with Your Insurance Provider: Keep your insurance provider informed of any major changes in your life, such as a new home purchase, a business venture, or a significant increase in assets.

- Stay Informed About Industry Trends: Keep up-to-date on industry trends and changes in liability laws that may affect your coverage needs.

- Consider Additional Coverage: Explore additional coverage options, such as coverage for cyber liability or professional liability, if applicable.

Final Conclusion

In conclusion, umbrella insurance stands as a crucial component of a robust financial plan, offering a vital layer of protection against unforeseen liabilities. By understanding the nuances of umbrella insurance, exploring your coverage options, and securing a policy that meets your specific needs, you can navigate the uncertainties of life with greater confidence, knowing that your assets are shielded from catastrophic financial losses.