Navigating the world of phone insurance can feel like a labyrinth, especially when dealing with unexpected repairs or replacements. T-Mobile offers a robust insurance program designed to protect your device, but knowing how to contact them quickly and efficiently is crucial. This guide will walk you through the T-Mobile insurance phone number, your direct line to swift support and peace of mind.

T-Mobile’s insurance program is a lifeline for those who rely heavily on their phones for work, communication, and entertainment. It offers protection against accidental damage, theft, and even malfunctions. Understanding the various coverage options, enrollment process, and claim procedures is essential to making the most of this valuable service.

T-Mobile Insurance Overview

T-Mobile Insurance, offered through Assurant, provides protection against accidental damage, theft, and malfunctions for your eligible T-Mobile device. The program aims to provide peace of mind and financial security by minimizing the financial burden associated with unexpected device damage or loss.

Coverage Options

T-Mobile Insurance offers various coverage options tailored to different needs and budgets.

- Device Protection Plus: This comprehensive plan covers accidental damage, theft, and malfunctions, offering the highest level of protection. It includes deductible options ranging from $29 to $99, with a maximum of two claims per 12-month period.

- Device Protection: This plan offers coverage for accidental damage and malfunctions, excluding theft. It provides a deductible option of $49 and allows for two claims per 12-month period.

- Screen Protection: This plan specifically covers damage to your device’s screen, offering a deductible option of $29 and allowing for two claims per 12-month period.

Benefits of T-Mobile Insurance

T-Mobile Insurance offers numerous benefits, including:

- Financial Protection: By covering unexpected device damage or loss, T-Mobile Insurance helps minimize financial burdens and provides peace of mind.

- Convenient Claims Process: T-Mobile offers a straightforward and user-friendly claims process, allowing you to file claims online or via phone.

- Fast Repair or Replacement: T-Mobile Insurance aims to provide quick repair or replacement services, minimizing the time you are without your device.

- Coverage for Malfunctions: Unlike some insurance programs, T-Mobile Insurance covers device malfunctions, offering protection against unexpected technical issues.

Limitations of T-Mobile Insurance

While T-Mobile Insurance offers comprehensive coverage, it also has certain limitations:

- Deductibles: Each coverage plan comes with a deductible, which you are responsible for paying when filing a claim.

- Claim Limits: T-Mobile Insurance imposes limits on the number of claims you can file within a specific period.

- Excluded Damages: Certain damages are excluded from coverage, such as damage caused by negligence, intentional acts, or wear and tear.

- Device Eligibility: Not all devices are eligible for T-Mobile Insurance.

Obtaining T-Mobile Insurance

Securing T-Mobile insurance is a straightforward process that involves a few simple steps. This insurance plan safeguards your mobile device against accidental damage, theft, and other unforeseen events, providing peace of mind and financial protection.

Eligibility Requirements

To be eligible for T-Mobile insurance, you must meet certain criteria. These requirements ensure that the insurance program is accessible to a wide range of customers while maintaining its financial viability.

- You must be a T-Mobile customer with an active line of service.

- Your device must be eligible for coverage. This generally includes smartphones and tablets purchased from T-Mobile or through authorized retailers.

- You must have a valid credit card or debit card for payment purposes.

Enrollment Methods

T-Mobile offers multiple ways to enroll in its insurance program, allowing you to choose the method that best suits your preferences and convenience.

- Online Enrollment: You can easily enroll in T-Mobile insurance through the company’s website. This method allows you to complete the process at your own pace and access detailed information about the insurance plan.

- T-Mobile App: The T-Mobile app provides a convenient platform to enroll in insurance. This option allows you to manage your account and insurance policy directly from your mobile device.

- T-Mobile Store: You can visit a T-Mobile store to enroll in insurance. This option provides the opportunity to interact with a representative who can answer any questions and guide you through the enrollment process.

- Phone Call: T-Mobile offers customer service support via phone. You can call their dedicated insurance line to enroll in the plan and address any inquiries you may have.

T-Mobile Insurance Phone Number

T-Mobile offers a dedicated phone number for customers seeking assistance with their insurance plans. This number provides a direct line to a team of insurance specialists who can address inquiries, resolve issues, and guide you through various aspects of your insurance coverage.

Contacting T-Mobile Insurance

To reach T-Mobile insurance, dial 1-800-937-8997. This number is available 24 hours a day, seven days a week, providing convenient access to support whenever you need it.

Optimal Times to Call

While T-Mobile Insurance is available 24/7, you may experience shorter wait times and potentially faster service during specific periods. Consider calling during off-peak hours, such as early mornings, late evenings, or weekends, when call volumes tend to be lower.

Contacting T-Mobile Insurance

While phone calls remain a primary method for contacting T-Mobile Insurance, the company offers alternative channels for support and claim submission. These methods provide flexibility and convenience for customers seeking assistance.

Online Support

T-Mobile provides comprehensive online resources for customers seeking information or assistance with their insurance plans. The company’s website serves as a central hub for accessing various support services.

- Frequently Asked Questions (FAQs): The T-Mobile website features a dedicated FAQ section that addresses common inquiries regarding insurance plans, coverage, claims, and other related topics. This resource can quickly answer basic questions without requiring direct contact with customer service.

- Online Chat: For real-time assistance, T-Mobile offers a live chat feature on its website. This allows customers to engage in instant conversations with customer service representatives for immediate support and guidance.

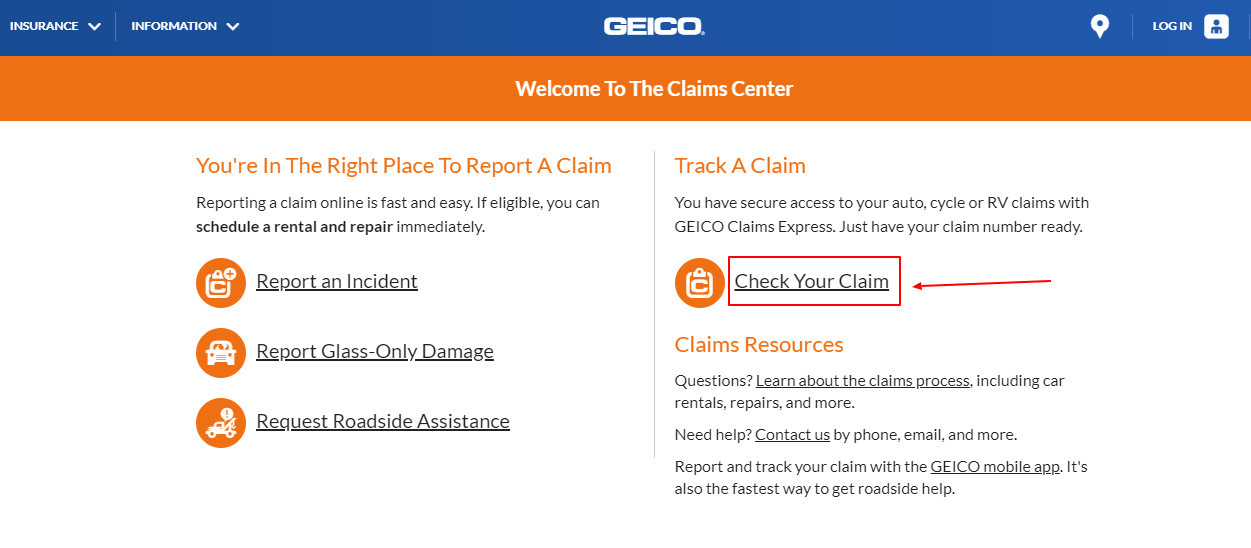

- Online Claim Submission: T-Mobile enables customers to file claims directly through its website. This online process simplifies the claim submission procedure, eliminating the need for phone calls or physical paperwork.

Mobile App

T-Mobile’s mobile app provides a convenient platform for managing insurance plans and accessing support on the go. The app offers a range of features, including:

- Policy Management: The app allows users to view their policy details, update personal information, and manage coverage options.

- Claim Submission: Similar to the website, the app enables customers to submit claims electronically, streamlining the process and providing instant updates.

- Contact Support: The app provides direct access to T-Mobile’s customer support team through a dedicated contact option, allowing users to quickly reach out for assistance.

T-Mobile Insurance Costs

T-Mobile insurance costs are designed to be affordable and provide coverage for your device in case of accidental damage or theft. The pricing structure is based on a tiered system, with the cost varying based on the device’s value and the level of coverage selected.

Factors Influencing Insurance Costs

Several factors contribute to the final cost of T-Mobile insurance. These include:

- Device Value: The cost of insurance is directly tied to the value of your device. More expensive phones will naturally have higher insurance premiums.

- Coverage Level: T-Mobile offers different coverage levels, with higher levels typically resulting in increased premiums. The ‘Jump! Unlimited’ plan, for example, includes a higher deductible compared to the ‘Jump! Premium’ plan, leading to lower insurance costs.

- Deductible: The deductible you choose will affect your insurance costs. A higher deductible will mean lower monthly premiums but higher out-of-pocket expenses in case of a claim.

Payment Options

T-Mobile offers several payment options for its insurance plans:

- Monthly Payments: You can pay for your insurance monthly, adding the cost to your T-Mobile bill. This is a convenient option for spreading out the cost over time.

- Annual Payments: You can choose to pay for your insurance annually, which may result in a slight discount compared to monthly payments.

T-Mobile Insurance Claims Process

T-Mobile Insurance offers a comprehensive claims process for customers who experience damage or loss of their covered devices. The process is designed to be straightforward and efficient, allowing customers to quickly get their phones repaired or replaced.

Filing a Claim

To file a claim, customers can choose from multiple options, including:

- Online: Customers can file a claim through the T-Mobile website, which offers a user-friendly interface for submitting claim information and uploading supporting documentation.

- Phone: T-Mobile Insurance has a dedicated customer service line that customers can call to file a claim. This option is particularly helpful for customers who prefer to speak with a representative or require assistance with the process.

- T-Mobile Store: Customers can visit a T-Mobile store to file a claim in person. This option allows for direct interaction with a T-Mobile representative, providing immediate assistance and clarification on the process.

Required Documentation

To ensure a smooth and efficient claim process, customers are typically required to provide the following documentation:

- Proof of Purchase: This document verifies the device ownership and eligibility for insurance coverage. Examples include the original sales receipt or invoice.

- Device IMEI Number: The IMEI number serves as a unique identifier for the device, confirming its identity and enabling T-Mobile to track its history and coverage status.

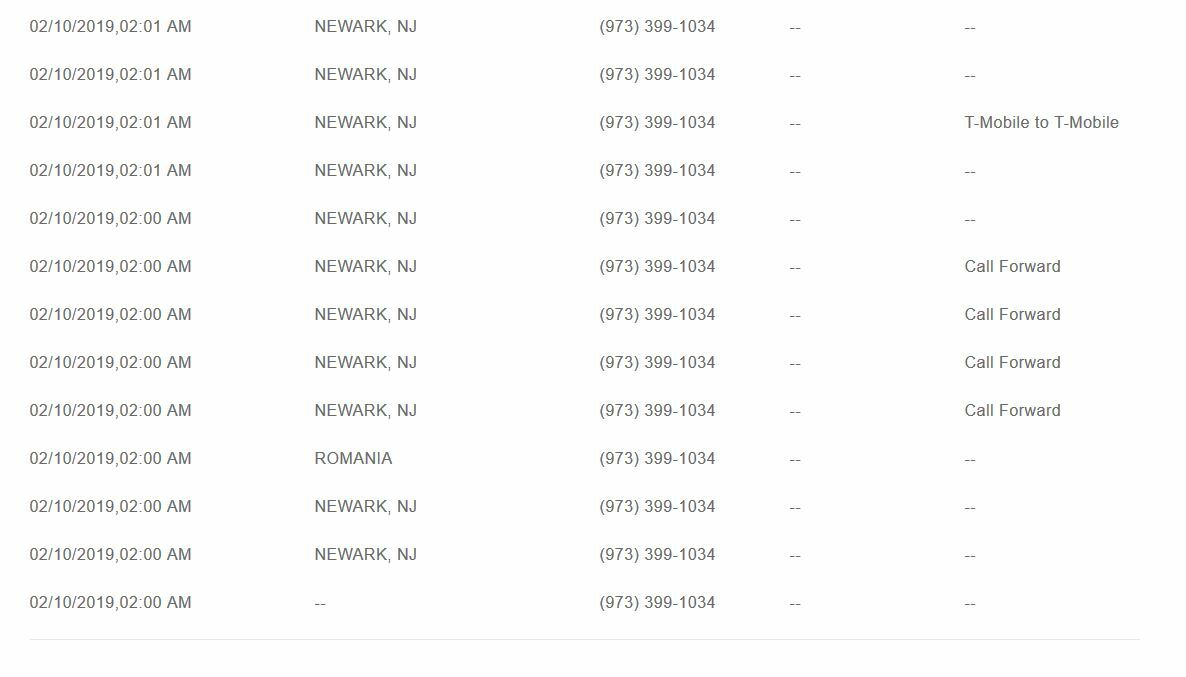

- Description of the Incident: A detailed description of the event that led to the damage or loss of the device, including the date, time, and location of the incident.

- Photos or Videos: Visual evidence of the damage or loss, such as photos of the damaged device or a police report for a stolen phone.

Claim Processing Timeframe

T-Mobile aims to process claims efficiently, with a typical timeframe of 2-3 business days for approval. However, the processing time may vary depending on the complexity of the claim, the availability of required documentation, and the device’s repair or replacement status.

T-Mobile Insurance Reviews and Feedback

T-Mobile insurance has garnered a mixed bag of reviews from customers, reflecting a range of experiences with the program. Understanding the common themes and trends in customer feedback can provide valuable insights into customer satisfaction and areas where T-Mobile can potentially improve its insurance offerings.

Customer Satisfaction and Common Themes

Customer satisfaction with T-Mobile insurance varies depending on individual experiences and expectations. Reviews often highlight both positive and negative aspects of the program. Here are some common themes that emerge from customer feedback:

- Positive Reviews: Many customers praise T-Mobile insurance for its affordability, ease of use, and prompt claim processing. They appreciate the convenience of having insurance directly through their mobile carrier, simplifying the process of protecting their devices.

- Negative Reviews: Some customers express dissatisfaction with the deductible amounts, limited coverage options, and potential delays in claim processing. These concerns highlight the importance of carefully evaluating the coverage details and considering alternative insurance options.

Customer Reviews on Third-Party Platforms

Online review platforms, such as Trustpilot and ConsumerAffairs, offer a wealth of information about customer experiences with T-Mobile insurance. Analyzing these reviews can provide a comprehensive picture of customer sentiment.

- Trustpilot: T-Mobile insurance has a 3.5-star rating on Trustpilot, based on over 1,000 reviews. While many customers praise the affordability and ease of use, others complain about slow claim processing and limited coverage options. Some customers highlight the importance of reading the fine print carefully to understand the limitations of the coverage.

- ConsumerAffairs: T-Mobile insurance receives a 3.5-star rating on ConsumerAffairs, with a similar mix of positive and negative reviews. Customers appreciate the convenience of having insurance through their mobile carrier, but some express concerns about the deductibles and coverage limitations. There are also reports of difficulties contacting customer service and resolving claims.

Analyzing Customer Feedback

Analyzing customer reviews reveals several key takeaways:

- Affordability: T-Mobile insurance is generally perceived as affordable compared to other insurance options. This is a significant factor for many customers, particularly those seeking budget-friendly protection for their devices.

- Convenience: Customers appreciate the convenience of having insurance directly through their mobile carrier. The integrated nature of the program simplifies the process of protecting devices and filing claims.

- Claim Processing: While many customers report positive experiences with claim processing, some express concerns about delays and difficulties. These issues highlight the importance of T-Mobile ensuring efficient and transparent claim handling.

- Coverage Limitations: Some customers find the coverage limitations, such as deductibles and exclusions, to be restrictive. This underscores the need for T-Mobile to provide clear and comprehensive information about the scope of coverage.

Insights into Customer Satisfaction

The mixed reviews suggest that T-Mobile insurance has both strengths and weaknesses. While its affordability and convenience are attractive features, the program’s limitations, such as deductibles, coverage options, and claim processing issues, can lead to dissatisfaction among some customers. T-Mobile should strive to address these concerns to enhance customer satisfaction and improve the overall value proposition of its insurance program.

T-Mobile Insurance Alternatives

While T-Mobile Insurance offers coverage for your smartphone, other providers might offer better deals or more comprehensive protection. Exploring alternatives can help you find the best insurance plan for your needs and budget.

Comparing Alternative Phone Insurance Providers

Several reputable companies offer phone insurance besides T-Mobile. Here’s a comparison of some popular alternatives, highlighting their advantages and disadvantages:

- Asurion: A leading provider of mobile device protection, Asurion offers comprehensive coverage for accidental damage, theft, and malfunctions.

- Advantages: Wide network of repair centers, quick claim processing, and various deductible options.

- Disadvantages: Can be more expensive than other providers, and the deductible might be higher for newer devices.

- SquareTrade: Known for its transparent pricing and customizable plans, SquareTrade offers protection against accidental damage, theft, and malfunctions.

- Advantages: Affordable plans, flexible coverage options, and excellent customer service.

- Disadvantages: May not offer as wide a network of repair centers as Asurion, and the deductible might be higher for older devices.

- AppleCare+: Apple’s extended warranty program provides comprehensive protection for Apple devices, including accidental damage and malfunctions.

- Advantages: Excellent repair service and coverage for Apple devices, often includes software support.

- Disadvantages: Only available for Apple devices, can be expensive, and may have limitations on the number of claims.

- Amazon Protect: Amazon’s device protection plan covers accidental damage, theft, and malfunctions for various electronic devices, including smartphones.

- Advantages: Convenient for Amazon Prime members, often bundled with other Amazon services, and offers a wide range of device coverage.

- Disadvantages: May have limitations on the types of devices covered, and the deductible might be higher than other providers.

Choosing the Best Phone Insurance Option

The best phone insurance option depends on your individual needs and budget. Here are some factors to consider:

- Device type: If you own an Apple device, AppleCare+ might be the best option. For other devices, Asurion, SquareTrade, or Amazon Protect can provide comprehensive coverage.

- Coverage needs: Consider the level of protection you require. If you’re prone to accidents or live in a high-theft area, comprehensive coverage is crucial. If you’re more cautious, a basic plan might suffice.

- Budget: Phone insurance premiums vary significantly. Compare quotes from different providers to find the most affordable option that meets your needs.

- Claims process: Evaluate each provider’s claims process. Some providers offer faster processing and more convenient options, like online claims filing.

Additional Considerations

Beyond the factors mentioned above, consider the following:

- Deductibles: Deductibles are the amount you pay out-of-pocket for each claim. Choose a deductible that fits your budget and risk tolerance.

- Replacement value: Some providers offer replacement with a new device, while others offer a cash payout. Consider your preference for a new device or cash compensation.

- Customer service: Look for a provider with a good reputation for customer service and responsive claims handling.

T-Mobile Insurance FAQs

T-Mobile insurance offers protection against accidental damage, theft, and other unforeseen events that may affect your device. This comprehensive coverage can provide peace of mind, knowing that your valuable smartphone or tablet is insured. Understanding the intricacies of T-Mobile insurance can be crucial in making informed decisions about your coverage. Here are some frequently asked questions to guide you through the process.

Eligibility for T-Mobile Insurance

The eligibility criteria for T-Mobile insurance vary depending on your device, plan, and other factors. Here are some important considerations:

- To be eligible for T-Mobile insurance, your device must be purchased from T-Mobile or authorized retailers.

- T-Mobile insurance is typically available for devices on T-Mobile’s postpaid plans, but it may not be available for prepaid plans.

- There might be specific device models or brands that are not covered under T-Mobile insurance.

T-Mobile Insurance Coverage

T-Mobile insurance provides coverage for a range of events that may damage or compromise your device. These include:

- Accidental damage: This covers damage caused by drops, spills, and other unintentional incidents.

- Theft: If your device is stolen, T-Mobile insurance may help replace it.

- Liquid damage: This covers damage caused by accidental spills or submersion in water.

T-Mobile Insurance Costs

The cost of T-Mobile insurance varies depending on the type of device, plan, and coverage options. You can expect to pay a monthly premium for the insurance coverage. T-Mobile offers different insurance plans with varying coverage levels and deductible amounts. You can choose a plan that best suits your needs and budget.

T-Mobile Insurance Claims Process

Filing a claim for T-Mobile insurance is typically a straightforward process. You can usually file a claim online, through the T-Mobile app, or by calling customer support.

- You will need to provide information about the incident, such as the date and time of the event, the location, and the type of damage.

- T-Mobile may require you to provide proof of the incident, such as a police report for theft or photos of the damage.

- Once your claim is approved, T-Mobile will either repair or replace your device, depending on the damage.

T-Mobile Insurance Deductibles

T-Mobile insurance plans often have deductibles, which are the amounts you pay out of pocket before the insurance coverage kicks in. The deductible amount can vary depending on the plan you choose.

- A higher deductible typically translates to a lower monthly premium, while a lower deductible may result in a higher monthly premium.

- It is important to consider your risk tolerance and budget when deciding on a deductible amount.

T-Mobile Insurance Limitations

While T-Mobile insurance offers valuable protection, it is essential to understand its limitations. These limitations can include:

- Coverage may not be available for all devices or plan types.

- There may be specific exclusions, such as damage caused by intentional acts or negligence.

- T-Mobile insurance may not cover all repair costs, and you may be responsible for any remaining balance.

T-Mobile Insurance vs. Other Insurance Options

T-Mobile insurance is not the only option for protecting your device. You may also consider other insurance providers or warranties that offer similar coverage.

- It is important to compare different options to find the best coverage and pricing that meet your needs.

- Factors to consider when comparing insurance options include coverage levels, deductibles, premiums, and claims processes.

T-Mobile Insurance Tips and Tricks

T-Mobile Insurance offers valuable protection for your smartphone, but there are several tips and tricks to maximize its benefits and avoid common pitfalls. By following these strategies, you can ensure you’re getting the most out of your T-Mobile Insurance policy.

Understanding Coverage Limits

Knowing the limits of your T-Mobile Insurance policy is crucial. While it covers accidental damage, theft, and other perils, there are specific coverage limits for each event. For example, the maximum payout for a damaged phone might be limited to a certain amount, regardless of the device’s original price. Carefully review your policy documents to understand these limits and avoid any surprises during a claim.

Last Word

T-Mobile insurance is more than just a safety net; it’s a commitment to providing customers with reliable protection and a smooth experience. By understanding the insurance program, utilizing the dedicated phone number, and exploring the available support channels, you can confidently navigate any unexpected challenges with your device. Remember, a little proactive research can go a long way in ensuring you’re prepared for any eventuality.