For homeowners in high-risk areas prone to landslides, securing adequate insurance is paramount. Traditional homeowners policies often fall short in covering the unique devastation of a landslide, leaving property owners vulnerable to catastrophic financial losses. This necessitates a deeper understanding of slide home insurance, a specialized coverage designed to protect against the specific perils of ground movement.

This guide dissects the complexities of slide home insurance, from eligibility criteria and coverage options to the claims process and cost factors. We’ll compare it to other insurance types, explore finding suitable providers, and delve into the legal and regulatory landscape. Ultimately, we aim to equip readers with the knowledge needed to navigate this specialized market and make informed decisions about protecting their most valuable asset: their home.

Defining “Slide Home Insurance”

Slide home insurance, a relatively niche product, addresses a specific gap in traditional homeowners insurance: the risk of foundation damage due to soil movement or shifting. Unlike standard policies that often exclude such events, slide home insurance provides coverage for repairs resulting from these geological shifts, offering critical protection for homeowners in areas prone to landslides or other ground instability. This specialized coverage is particularly relevant in regions with challenging geological conditions, where the risk of foundation damage is significantly higher than average.

Slide home insurance operates by providing financial protection against the considerable costs associated with repairing or stabilizing a home’s foundation after it has been compromised by ground movement. This can encompass a range of remediation efforts, from minor crack repairs to extensive foundation reconstruction, depending on the severity of the damage. The policy’s coverage details are crucial, as the extent of the damage and the required repair work can vary greatly.

Types of Slide Home Insurance Policies

Slide home insurance policies are not uniform. The specific coverage offered can vary considerably between insurers and policies. Some policies might cover only the foundation itself, while others may extend coverage to related structural damage, such as cracks in walls or floors. The policy limits, deductibles, and exclusions also differ significantly. It’s vital for prospective buyers to carefully review the policy wording to understand precisely what is and is not covered. This careful examination is essential to avoid unpleasant surprises in the event of a claim.

Slide Home Insurance vs. Traditional Homeowners Insurance

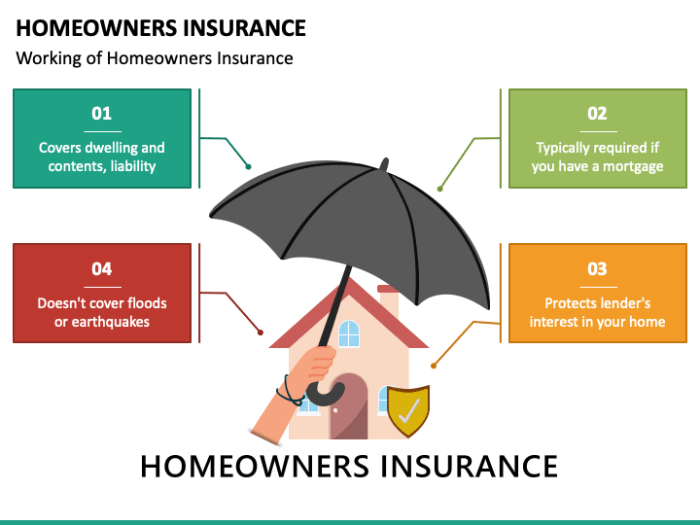

Traditional homeowners insurance policies typically exclude coverage for damage caused by gradual soil movement or land subsidence. This exclusion is primarily due to the unpredictable and often slow-onset nature of these events, making them difficult to assess and insure in the same way as more sudden and easily quantifiable risks, such as fire or wind damage. In contrast, slide home insurance is specifically designed to address this gap, providing coverage where traditional policies fall short. A homeowner facing foundation damage from a landslide would find their traditional policy insufficient, necessitating a separate slide home insurance policy to cover the extensive repair costs. The key difference lies in the specific perils covered; traditional policies focus on sudden and accidental events, while slide home insurance tackles the gradual, earth-related risks.

Eligibility Criteria for Slide Home Insurance

Securing slide home insurance, a specialized coverage for homes susceptible to landslides or mudslides, hinges on a rigorous assessment of risk by insurance providers. This assessment considers various factors, impacting both the availability and cost of the policy. Understanding these criteria is crucial for homeowners in high-risk areas.

Property Location and Geological Assessment

Insurance companies meticulously evaluate the property’s location concerning geological instability. This involves detailed analysis of factors like proximity to unstable slopes, historical landslide activity in the area, soil composition, and the presence of any underlying geological weaknesses. High-resolution topographic maps and geological surveys are often used to pinpoint areas with increased landslide risk. For instance, a property situated on a steep slope with evidence of previous landslides will likely face stricter eligibility requirements or higher premiums compared to a property on stable, flat ground. The presence of drainage systems and erosion control measures also influences the risk assessment. A property with inadequate drainage, for example, might be deemed ineligible unless significant improvements are made.

Property Construction and Design

The structural integrity and design of the home significantly impact eligibility. Insurance providers assess the building’s foundation, its resistance to ground movement, and the overall quality of construction. Homes built with robust foundations, designed to withstand ground shifts, and constructed using high-quality materials are more likely to meet eligibility criteria. Conversely, older homes with outdated construction techniques or compromised foundations may face higher premiums or even be deemed ineligible. Furthermore, the presence of retaining walls, hillside stabilization techniques, and other mitigating measures can positively influence the assessment. A well-engineered retaining wall, for example, might significantly reduce the perceived risk and improve the chances of eligibility.

Credit Score and Claims History

While not directly related to landslide risk, a homeowner’s credit score and claims history play a role in eligibility. Insurance companies often use credit scores as an indicator of financial responsibility, impacting the underwriting process. A lower credit score might lead to higher premiums or even rejection of the application. Similarly, a history of insurance claims, regardless of the nature of the claim, can negatively influence eligibility. Frequent claims, even for unrelated incidents, might suggest higher risk and lead to increased premiums or difficulty securing coverage. This reflects the insurer’s assessment of the likelihood of future claims and the potential financial burden. For example, a homeowner with a history of multiple claims might find it challenging to obtain slide home insurance, even if their property’s location is considered relatively safe.

Coverage Options and Exclusions

Slide home insurance, a niche product designed to protect against specific risks associated with manufactured homes, offers a range of coverage options, but also features key exclusions. Understanding both is crucial for securing adequate protection. Policyholders should carefully review their specific policy documents for complete details, as coverage can vary significantly between insurers and states.

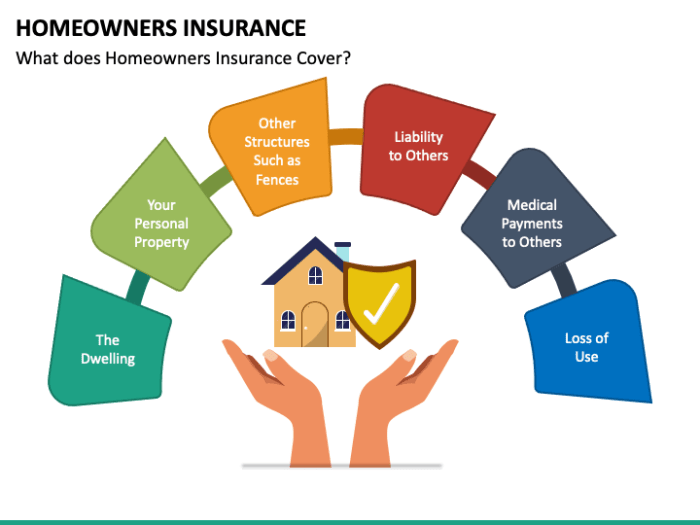

Common Coverage Options

Slide home insurance policies typically cover damage to the home’s structure from various perils. This includes coverage for damage caused by fire, wind, hail, lightning, and vandalism. Many policies also extend coverage to include liability protection, offering financial security in case someone is injured on your property. Additional coverage options often available include personal property protection (covering belongings inside the home), loss of use coverage (covering additional living expenses if your home is uninhabitable), and optional upgrades to increase coverage limits for specific perils. The precise inclusions depend heavily on the insurer and the chosen policy.

Typical Exclusions

While slide home insurance offers substantial protection, several common exclusions exist. These typically include damage caused by normal wear and tear, improper maintenance, or flooding from sources other than a named storm. Insect or rodent infestation, earth movement (unless specifically covered as an add-on), and damage resulting from a lack of preventative maintenance are often excluded. Furthermore, many policies exclude coverage for damage caused by intentional acts of the policyholder. It is essential to understand these exclusions to avoid unexpected costs in the event of a claim.

Coverage Limits Comparison

Coverage limits and exclusions vary significantly among insurers. The following table illustrates hypothetical examples from three different insurers (Insurer A, Insurer B, and Insurer C) to highlight these variations. These are for illustrative purposes only and do not represent actual insurer offerings. Always consult directly with insurers for accurate and up-to-date information.

| Coverage Type | Insurer A Limit | Insurer A Exclusions | Insurer B Limit | Insurer B Exclusions | Insurer C Limit | Insurer C Exclusions |

|---|---|---|---|---|---|---|

| Dwelling Coverage | $150,000 | Flood (unless add-on), earth movement | $200,000 | Flood, earth movement, insect infestation | $175,000 | Flood, earth movement, wear and tear |

| Personal Property | $75,000 | Scheduled items only | $100,000 | Scheduled items only | $87,500 | Scheduled items only, cash |

| Liability | $100,000 | Intentional acts | $300,000 | Intentional acts, business activities | $200,000 | Intentional acts |

| Loss of Use | 20% of Dwelling Coverage | Vacancy exceeding 30 days | 25% of Dwelling Coverage | Vacancy exceeding 60 days | 15% of Dwelling Coverage | Vacancy exceeding 30 days |

Cost Factors and Pricing

Slide home insurance premiums, like other forms of property insurance, are influenced by a complex interplay of factors. Understanding these elements is crucial for securing affordable and adequate coverage. The cost isn’t simply a fixed rate; it’s a dynamic calculation reflecting the insurer’s assessment of risk.

Property location significantly impacts premiums. Areas prone to natural disasters, such as wildfires, hurricanes, or earthquakes, command higher premiums due to the increased likelihood of claims. Similarly, properties in high-crime areas may attract higher rates reflecting the elevated risk of theft or vandalism. Proximity to fire hydrants, the quality of local fire services, and even the type of construction materials used in the home all contribute to the insurer’s risk assessment.

Property Location and Risk Factors

Insurers utilize sophisticated models to assess risk, factoring in historical claims data for specific geographic locations. A property situated in a flood plain, for example, will automatically attract a higher premium than a comparable property located on higher ground. Similarly, homes built with less fire-resistant materials, or those lacking adequate safety features, will generally incur higher premiums. These risk factors are not arbitrary; they are based on statistical analysis and actuarial science. For instance, a home in Malibu, California, known for its wildfire risk, will likely command a substantially higher premium than a similar home in a less fire-prone region. Conversely, a home with a comprehensive security system and fire-resistant roofing materials may qualify for discounts.

Methods for Obtaining Competitive Quotes and Saving Money

Consumers should actively compare quotes from multiple insurers to secure the most competitive rates. Online comparison tools can streamline this process, allowing for side-by-side comparisons of coverage options and premiums. However, it’s crucial to ensure that the coverage offered is truly comparable across insurers; subtle differences in policy wording can significantly impact claim payouts. Furthermore, maintaining a good credit history can often lead to lower premiums, as insurers consider credit scores as an indicator of risk. Discounts are frequently offered for bundling insurance policies (e.g., combining home and auto insurance), opting for higher deductibles, or installing safety features like smoke detectors or security systems. Negotiating with insurers can also sometimes yield savings, particularly for long-term policy holders with a clean claims history.

Claim Process and Procedures

Filing a claim for slide home insurance involves a straightforward process designed to ensure timely and efficient resolution for policyholders. The insurer aims to minimize disruption and provide financial assistance as quickly as possible following a covered event. Understanding the steps involved and the necessary documentation will facilitate a smoother claims experience.

The initial step requires the policyholder to promptly report the incident to their insurer. This notification should ideally occur as soon as it is safe to do so, following any necessary emergency response actions. A detailed description of the event, including date, time, and location, is crucial. The policy number should also be readily available.

Documentation Requirements

Supporting a slide home insurance claim necessitates providing comprehensive documentation to verify the incident and its impact. This documentation serves as evidence to substantiate the claim and expedite the assessment process. Incomplete or missing documentation can significantly delay the claim settlement.

- Police Report (if applicable): A police report is often required for incidents involving theft, vandalism, or other criminal activities. This report should include details of the incident, any witnesses, and the estimated value of the damage.

- Photographs and Videos: Visual evidence is critical. Detailed photographs and videos showcasing the damage to the home are essential. These should capture the extent of the damage from multiple angles, including close-ups of specific areas affected.

- Contractor Estimates: Obtaining estimates from qualified contractors for repairs or replacements is crucial. These estimates should itemize the necessary repairs and provide a breakdown of labor and material costs. Multiple estimates are recommended to ensure competitive pricing.

- Proof of Ownership: Documentation establishing ownership of the property, such as a deed or mortgage statement, is required. This confirms the policyholder’s entitlement to claim benefits under the policy.

Claim Processing and Settlement Timeframe

The time required to process and settle a slide home insurance claim varies depending on several factors, including the complexity of the claim, the availability of documentation, and the insurer’s internal procedures. While insurers strive for prompt resolution, unforeseen circumstances can occasionally cause delays.

Generally, the insurer initiates an investigation upon receiving the claim. This involves reviewing the provided documentation, potentially conducting an on-site inspection of the property, and verifying the extent of the damage. Following the investigation, the insurer will issue a determination on the claim, specifying the amount of coverage approved. In cases involving significant damage or complex claims, the process may take several weeks or even months. For example, a claim involving extensive structural damage requiring extensive engineering assessments could take longer to process compared to a claim for minor repairs. Clear and consistent communication between the policyholder and the insurer is key throughout the process.

Benefits and Drawbacks of Slide Home Insurance

Slide home insurance, a relatively niche product, presents a unique value proposition compared to traditional homeowners insurance. Understanding its advantages and disadvantages is crucial for determining its suitability within specific risk profiles and financial situations. This analysis will explore the key benefits and drawbacks, ultimately clarifying its place within the broader landscape of home insurance options.

Advantages of Slide Home Insurance

Slide home insurance offers several compelling advantages, particularly for homeowners in specific circumstances. The primary benefit lies in its targeted coverage, often focusing on specific, high-value assets or potential risks within the home. This allows for customized protection tailored to individual needs, potentially leading to lower premiums than comprehensive policies covering less relevant risks. This tailored approach can be particularly beneficial for homeowners with unique or high-value possessions, such as valuable artwork, antique furniture, or specialized equipment.

Disadvantages of Slide Home Insurance

Despite its advantages, slide home insurance possesses limitations. The most significant drawback is the potential for gaps in coverage. Because it focuses on specific aspects of the home and its contents, it may not offer the broad protection provided by a traditional homeowners policy. This means that unforeseen events not explicitly covered by the slide policy could leave the homeowner financially exposed. For instance, a slide policy focusing solely on flood damage would not cover fire damage. Another potential disadvantage is the complexity of the policy structure. Understanding the precise scope of coverage and exclusions may require careful review and potentially professional guidance, unlike the simpler, more standardized structure of traditional policies.

Comparison to Alternative Solutions

The overall value proposition of slide home insurance depends heavily on the individual homeowner’s circumstances. For homeowners with high-value, easily damaged items or specific risk exposures, a slide policy might offer a more cost-effective and focused approach than a comprehensive policy. However, for homeowners with more modest possessions and a lower risk profile, a traditional homeowners policy might offer better overall value and broader protection against a wider range of potential losses. Consider a homeowner with a valuable collection of rare books. A slide policy covering only this collection might be more cost-effective than a comprehensive policy that includes coverage for this collection alongside standard home structure and contents protection. Conversely, a homeowner with a standard home and average possessions might find a traditional policy more cost-effective and comprehensive. The choice ultimately hinges on a careful assessment of individual needs and risk tolerance.

Comparison with Other Insurance Types

Slide home insurance, a relatively niche product, often overlaps with, yet distinctly differs from, more common insurance policies. Understanding these distinctions is crucial for homeowners seeking appropriate coverage. The following comparisons highlight key similarities and differences with flood, earthquake, and windstorm insurance.

Slide Home Insurance vs. Flood Insurance

Flood insurance, provided by the National Flood Insurance Program (NFIP) or private insurers, covers losses resulting from flooding. Slide home insurance, conversely, focuses on damage caused by the gradual movement of the land beneath a home. While both can lead to significant property damage and displacement, their triggers are fundamentally different.

- Coverage Trigger: Flood insurance covers damage from overflowing water bodies, while slide home insurance covers damage from land movement.

- Causes of Damage: Flood damage stems from rising water levels, while slide damage results from soil instability and ground shifts.

- Policy Exclusions: Flood insurance typically excludes damage from landslides, unless specifically endorsed, whereas slide home insurance explicitly excludes flood damage.

- Availability: Flood insurance is more widely available, particularly in high-risk flood zones, while slide home insurance is geographically limited to areas prone to land slippage.

Slide Home Insurance vs. Earthquake Insurance

Earthquake insurance, often offered as an add-on to homeowners’ policies, protects against damage caused by seismic activity. Slide home insurance, while potentially exacerbated by earthquakes, primarily addresses damage stemming from gradual land movement, regardless of seismic events.

- Underlying Cause: Earthquake insurance covers damage from ground shaking and related events, whereas slide home insurance covers damage from land subsidence or creep.

- Damage Manifestation: Earthquake damage is often sudden and catastrophic, while slide damage typically manifests gradually over time.

- Policy Coverage: Earthquake insurance may cover structural damage and contents, while slide home insurance might focus solely on structural damage resulting from land movement.

- Geographic Risk: Earthquake insurance is crucial in seismically active regions, while slide home insurance is vital in areas susceptible to landslides or soil instability.

Slide Home Insurance vs. Windstorm Insurance

Windstorm insurance, a component of many homeowners’ policies or available as separate coverage, protects against damage caused by high winds, hurricanes, and tornadoes. Slide home insurance, however, addresses damage from slow, creeping land movement, a process largely unaffected by sudden wind events.

- Type of Peril: Windstorm insurance covers damage from high-velocity winds, while slide home insurance addresses damage from gradual land movement.

- Damage Characteristics: Windstorm damage is often abrupt and widespread, affecting roofs, siding, and windows, while slide damage can be more localized and gradual, affecting foundations and structural integrity.

- Geographic Risk: Windstorm insurance is crucial in coastal or hurricane-prone areas, while slide home insurance is necessary in regions with unstable slopes or expansive soils.

- Policy Scope: Windstorm insurance often covers both structural damage and personal property, while slide home insurance may focus primarily on structural damage related to land movement.

Finding a Suitable Provider

Securing adequate slide home insurance requires careful consideration of various providers. The market offers a range of companies, each with its own strengths and weaknesses. A thorough research process is crucial to finding a policy that best suits individual needs and financial capabilities.

Choosing a reputable slide home insurance provider involves a multi-step process that goes beyond simply comparing premiums. Consumers must evaluate financial stability, claims handling processes, customer service responsiveness, and the breadth of coverage offered. Ignoring these factors can lead to significant difficulties should a claim need to be filed.

Provider Research Methods

Effective research involves exploring multiple avenues to gather comprehensive information on potential providers. This includes checking online reviews and ratings from independent sources like the Better Business Bureau (BBB) and AM Best, a credit rating agency specializing in the insurance industry. Direct comparison websites can offer a quick overview of various providers and their offerings, allowing for a preliminary assessment. Directly contacting several insurance companies to request quotes and detailed policy information is also recommended.

Criteria for Evaluating Insurance Companies

Several key factors should guide the evaluation of potential slide home insurance providers. Financial strength is paramount; a company’s financial stability directly impacts its ability to pay claims. Examining the company’s claims-handling process, including speed of response and customer service quality, is also critical. Policy coverage details, including specifics on what is and isn’t covered, should be meticulously reviewed. Finally, the overall cost, including premiums and any additional fees, should be compared across different providers.

Checklist for Comparing Insurance Providers

Before making a decision, consumers should utilize a checklist to ensure a thorough comparison. This checklist should include:

- Financial Stability Rating: Check ratings from AM Best or other reputable agencies.

- Claims Handling Process: Review customer reviews and seek information on average claim processing times.

- Policy Coverage Details: Carefully examine the policy document for specific coverage details, including exclusions and limitations.

- Customer Service Reputation: Look for reviews and testimonials that highlight the quality of customer service provided.

- Premium Costs and Fees: Compare premiums from multiple providers, considering any additional fees or surcharges.

- Policy Renewability: Understand the terms and conditions for renewing the policy, including any potential premium increases.

- Contact Information and Accessibility: Verify ease of contact with the provider through various channels (phone, email, online portal).

Understanding Policy Terms and Conditions

Navigating the complexities of slide home insurance necessitates a thorough understanding of the policy’s terms and conditions. Failure to comprehend these stipulations can lead to significant financial repercussions in the event of a claim. A careful review of the policy document is crucial to ensure coverage aligns with individual needs and expectations.

Policy terms often contain specialized vocabulary and legal jargon, potentially leading to misinterpretations. This section clarifies common terms and highlights potential areas of misunderstanding.

Key Policy Definitions

Slide home insurance policies employ specific terminology to define coverage parameters and limitations. Understanding these terms is fundamental to avoiding disputes during the claims process. For instance, the term “actual cash value” (ACV) frequently appears, representing the current market value of a damaged property, less depreciation. In contrast, “replacement cost” refers to the cost of replacing damaged property with new, comparable items, irrespective of depreciation. This difference can significantly impact the payout received after a claim. Another critical term is the “deductible,” the amount the policyholder must pay out-of-pocket before the insurer covers the remaining costs. Understanding the deductible amount is crucial in assessing the overall cost-effectiveness of the insurance policy. Furthermore, the policy will specify the coverage limits, the maximum amount the insurer will pay for a specific claim or in total over the policy period.

Importance of Thorough Policy Review

Before signing any slide home insurance policy, a comprehensive review of the entire document is paramount. This includes scrutinizing the fine print, paying close attention to exclusions, and clarifying any ambiguous terms with the insurer. Failing to do so may result in insufficient coverage or disputes during the claims process. Consider engaging an independent insurance professional to assist with the review if needed. Many policies contain specific clauses regarding the insured’s responsibilities in maintaining the property, such as regular inspections and preventative maintenance. Non-compliance with these stipulations could jeopardize the validity of a claim.

Potential Misunderstandings and Implications

A common misunderstanding involves the interpretation of exclusions. Policies often exclude coverage for specific events, such as damage caused by flooding or earthquakes, unless additional endorsements are purchased. Failing to understand these exclusions could lead to a denied claim, even if the damage seems covered under a broad interpretation of the policy. For example, a policy might exclude coverage for damage caused by gradual deterioration, such as settling foundation issues, unless explicitly stated otherwise. Another area of potential misunderstanding is the definition of “covered perils.” A clear understanding of what events are covered under the policy is crucial. Many policies list specific perils, such as fire, wind, or hail. If a loss is caused by a peril not listed, the claim may be denied. Finally, the definition of “reasonable and necessary repairs” can be a source of contention. Insurers may dispute the cost of repairs if they are deemed excessive or unnecessary, leading to disputes over claim settlements. A detailed understanding of the policy’s specific definition of these terms is essential for a successful claim.

Legal and Regulatory Aspects

Navigating the legal landscape surrounding slide home insurance requires understanding the interplay of federal and state regulations, consumer protection laws, and dispute resolution mechanisms. The specific regulations vary significantly by jurisdiction, highlighting the importance of consulting local authorities and legal professionals for precise guidance.

The insurance industry is heavily regulated to protect consumers and maintain market stability. These regulations often dictate minimum coverage requirements, underwriting practices, and claim settlement procedures. Failure to comply with these regulations can result in substantial penalties for insurance providers.

State Insurance Department Oversight

Each U.S. state maintains its own Department of Insurance, responsible for licensing insurers, reviewing policy forms, and investigating consumer complaints. These departments play a crucial role in ensuring that slide home insurance providers adhere to state laws and regulations. For instance, California’s Department of Insurance sets stringent requirements for disclosure and consumer protection, impacting how slide home policies are marketed and the information provided to policyholders. Similarly, New York’s Department of Financial Services has a robust regulatory framework for handling complaints and resolving disputes between insurers and policyholders. Consumers should familiarize themselves with their state’s specific regulations.

Consumer Protection Laws

Numerous federal and state laws protect consumers from unfair or deceptive insurance practices. These laws often mandate clear and concise policy language, prohibit unfair claim settlement practices, and provide avenues for redress in case of disputes. For example, the Unfair Claims Settlement Practices Act, adopted in many states, prohibits insurers from engaging in tactics like unreasonable delays in claim settlements or refusing to pay legitimate claims without justification. The specific protections available to consumers will vary depending on their state of residence and the specifics of their policy.

Dispute Resolution Processes

When disputes arise between policyholders and insurers, several avenues exist for resolving the matter. These include informal complaint procedures with the insurer, mediation, arbitration, and litigation. Many state insurance departments offer mediation services to help resolve disputes amicably. Arbitration provides a more formal process, with a neutral third party making a binding decision. If all else fails, litigation in civil court may be necessary. The choice of dispute resolution method will depend on the nature and severity of the dispute, the resources available to the parties, and the specific provisions of the insurance policy.

Future Trends in Slide Home Insurance

The slide home insurance market, while relatively niche, is poised for significant transformation driven by technological advancements and evolving consumer expectations. Predictive modeling, AI-powered risk assessment, and the increasing adoption of IoT devices are reshaping how risk is evaluated and policies are priced, leading to more personalized and efficient insurance products.

The integration of emerging technologies will fundamentally alter the landscape of slide home insurance. This includes improved risk assessment methodologies, enhanced fraud detection capabilities, and streamlined claims processing. The impact will be felt across all aspects of the industry, from underwriting to claims management.

Impact of Telematics and IoT Devices

The proliferation of smart home devices and telematics systems presents a unique opportunity for more accurate risk profiling in slide home insurance. Data from sensors monitoring environmental conditions, structural integrity, and even occupant behavior can be used to create highly personalized risk assessments. For instance, a system could detect early signs of foundation instability or water damage, enabling proactive interventions and potentially reducing claim payouts. This data-driven approach allows insurers to offer customized premiums reflecting the actual risk profile of each individual slide home, moving away from generalized risk assessments. This could lead to lower premiums for homeowners with well-maintained properties and more accurate pricing overall.

Artificial Intelligence and Predictive Modeling in Risk Assessment

AI and machine learning algorithms are increasingly utilized to analyze vast datasets, identifying previously unrecognized risk factors and improving the accuracy of predictive models. This allows insurers to better assess the likelihood of specific events, such as landslides or foundation failure, leading to more precise pricing and risk mitigation strategies. For example, AI could analyze historical weather patterns, geological data, and property characteristics to predict the probability of a slide occurring in a particular location with greater accuracy than traditional methods. This improved accuracy translates to fairer premiums for homeowners and more efficient risk management for insurers.

Hypothetical Scenario: Drone-Based Risk Assessment

Imagine a future where insurers utilize fleets of autonomous drones equipped with high-resolution cameras and advanced sensors to regularly inspect slide-prone areas. These drones could autonomously capture detailed images and data on soil conditions, vegetation, and property structures, providing insurers with up-to-date risk assessments. This real-time monitoring system would allow for early detection of potential hazards, enabling proactive measures to mitigate risk and potentially prevent costly claims. For example, a drone might detect early signs of erosion or ground instability, prompting an insurer to contact the homeowner and recommend preventative measures, ultimately reducing the likelihood of a slide-related claim. This proactive approach could lead to a significant reduction in insurance payouts and potentially lower premiums for homeowners in the long term.

Epilogue

Securing adequate protection against landslide damage requires a proactive approach. Understanding the nuances of slide home insurance, comparing providers, and carefully reviewing policy terms are critical steps in mitigating financial risk. While the complexities can seem daunting, the potential for devastating losses underscores the importance of diligent research and informed decision-making. By understanding the specifics of this crucial coverage, homeowners can safeguard their investment and achieve peace of mind.